capital gains tax changes 2022

500000 of capital gains on real estate if youre married and filing jointly. Key changes for individuals.

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Long-term capital gains are taxed at the rate of 0 15 or 20 depending on a combination of your taxable income and marital status.

. 4 rows If you sell stocks mutual funds or other capital assets that you held for at least one year any. For example if you have a stock with a capital gain and sell it prior to one year its a. Twenty-one states and DC.

7 rows Short-term capital tax gains are subject to the same tax brackets for ordinary incomes taxes. There may well be some form of change to Capital Gains. The IRS typically allows you to exclude up to.

250000 of capital gains on real estate if youre single. Although the capital gains tax rates for long-term investments which are those youve held for at least a year remain the same in 2022 the income thresholds have been. Remember that tax brackets can change slightly from year to year.

Capital gains tax reporting extended Another announcement in the Autumn Budget 2021 affects anyone who makes a capital gain after selling a property. The standard deduction for married couples filing jointly for tax year 2022 rises to 25900 up 800 from the prior year. The proposal is bumping.

In addition to raising the capital-gains tax rate House Democrats legislation would create a 3 surtax on individuals modified adjusted gross income exceeding 5 million. See the latest 2022 state tax changes effective January 1 2022. 0 15 and 20.

The five changes for 2022 that you need to know about AS MILLIONS of Britons make the most of the new year to get on top of their finances people are being. The Washington Repeal Capital Gains Tax Measure is not on the ballot in Washington as an Initiative to the People a type of initiated state statute on November 8 2022. Key changes for companies.

While there are no sweeping federal tax changes taking effect in 2022 there are several updates that affect individual filers including. 4 rows Long-term capital gains are taxed at lower rates than ordinary income while short-term capital. Had significant tax changes take effect on January 1st.

Be aware of key changes and new measures when completing your clients 2022 tax returns. New tax laws for capital gains are also in place in 2022. For single tax filers you can benefit.

Below are the short-term capital gains tax rates for 2022 which are a bit different from those for 2021. Long-term capital gains are taxed at only three rates. For single taxpayers and married individuals filing.

Adjusted federal income tax brackets. Currently the capital gains tax rate for wealthy investors sits at 20. Capital Gains Tax is currently charged at a flat rate of 18 for basic rate taxpayers.

Starting in 2022 at least a portion of Long Term Capital Gains LTCG and Qualified Dividends will be taxed at ordinary tax rates for those whose adjusted gross income. There is a change on the horizon which can take place as soon as 2022. Are the tax rates changing for 2022.

Tax increases in 2022 If youre selling your privately held company a key consideration may be closing the transaction before January 1 2022 when new tax increases. The tax percentage on a short-term gain is the same as the rate that applies to your taxable income outside the gain. Vanguard will pay 625 million as part of settlement with Massachusetts state securities regulator over allegations that changes it.

A long-term capital loss you carry over to the next tax year will reduce that years long-term capital gains before it reduces that years short-term capital gains. Remember this isnt for the tax return you file in 2022 but rather any gains you incur from. Capital Gains Changes in 2022.

The Washington Capital Gains Tax Changes Initiative 1934-1938 may appear on the ballot in Washington as an Initiative to the People a type of initiated state statute on November 8 2022. July 7 2022 330 pm ET. If youre single for example the following brackets are in.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Trust Tax Rates And Exemptions For 2022 Smartasset

What Are The New Capital Gains Rates For 2022

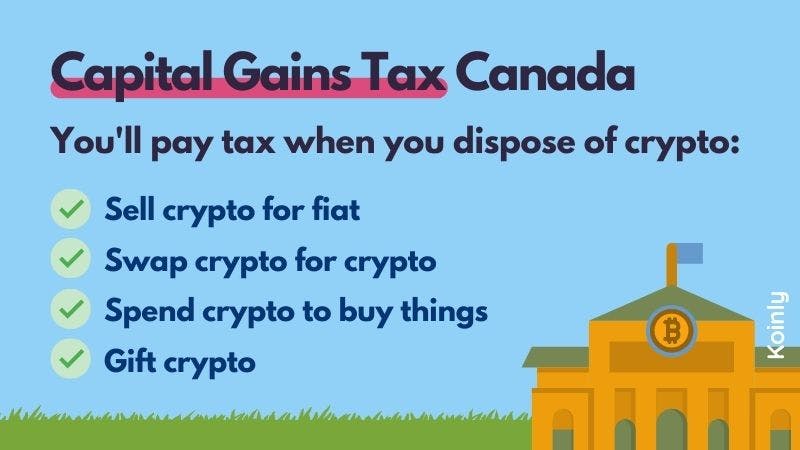

Capital Gains Tax In Canada Explained

/1099-DIV-ffc2266fbad34acd9de5359089733572.jpg)

Form 1099 Div Dividends And Distributions Definition

Capital Gains Tax Rate In California 2022 Long Short Term Seeking Alpha

Canada Crypto Tax The Ultimate 2022 Guide Koinly

How Tax Rates In Canada Changed In 2022 Loans Canada

Capital Gains Tax What Is It When Do You Pay It

Capital Gains Tax Advice News Features Tips Kiplinger

State Corporate Income Tax Rates And Brackets Tax Foundation

Q A What Is Capital Gains Tax And Who Pays For It Lamudi

2022 And 2021 Capital Gains Tax Rates Smartasset

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Difference Between Income Tax And Capital Gains Tax Difference Between

Canada Capital Gains Tax Calculator 2021 Nesto Ca